Select the right grant assistance program for your organization

Police

Select a product below to visit our grant expert partners at PoliceGrantsHelp.com. After completing the form on the next page, you will begin receiving grant assistance updates.

- Body cameras

- Drone software

- License plate recognition

- In-car video

- Video security & access control

- Records management system

- Crisis communication

- NG9-1-1 call management

- Radios

DOJ Body-Worn Camera Policy and Implementation Program (FY2025)

The U.S. Department of Justice (DOJ) has announced $22.8 million in grant funding through the Body-Worn Camera Policy and Implementation Program (BWCPIP). This initiative supports state, local, tribal, and territorial law enforcement and correctional agencies in implementing or expanding body-worn camera (BWC) programs. It also funds projects that enhance digital evidence management and cross-agency data sharing.

Key Details:

Application Deadlines:

- Grants.gov: October 27, 2025

- JustGrants: November 3, 2025

Funding Categories:

- Site-Based Awards for Law Enforcement Agencies (up to $2M each)

- Site-Based Awards for Correctional Agencies (up to $2M each)

- Digital Evidence Integration Demonstration Projects (up to $1M each)

Eligibility: State, county, and municipal governments, tribal governments, public safety agencies, correctional institutions, and educational entities.

Program Goals: Strengthen the evidentiary value of BWC footage, improve officer safety, and advance digital evidence management and sharing.

Match Requirement: 50% in-kind or cash match for Categories 1 & 2; none for Category 3.

Performance Period: 36 months, beginning October 1, 2025.

Motorola Solutions offers grant assistance and technology solutions—including body-worn cameras, CommandCentral Evidence, and SVX integrated camera/speaker mic units—to help agencies meet program goals.

Fire

Select a product below to visit our grant expert partners at FireGrantsHelp.com. After completing the form on the next page, you will begin receiving grant assistance updates.

Government

Select a product below to visit our grant expert partners at GovGrantsHelp.com. After completing the form on the next page, you will begin receiving grant assistance updates.

A Comprehensive Guide

to The Grants Process for

Law Enforcement Agencies

Grants are a great way for your department or agency to receive funding beyond the limits of your operational budget and bridge the gap between resources and needs. Grants can help pay for equipment like radios, vehicles, training, or even provide funding for additional personnel.

But to be successful in winning grants, agencies need to identify the right grants to pursue, write strong applications that state their case for needing grants funding, offer a transparent budget that reflects those needs and follow best practices in writing and administering grants.

This eBook will walk you through the process of creating a strong application and give concrete examples of mistakes to avoid and best practices for a successful application.

How can you find funding opportunities that apply to your needs? Click on the industry links below, and you'll find a simple summary of the grant requirements. You’ll also find application deadlines, webinars and presentation materials that further explain the opportunity, and case studies about how other users like you have used wireless solutions to improve their performance.

In The Spotlight

How To Prepare A Successful Grant Application

Unsure of how to prepare a grant application?

This guide provides useful preparation practices for anyone seeking additional grant support including:

- Strategic planning

- Researching grants

- Submitting and tracking your application

And much more

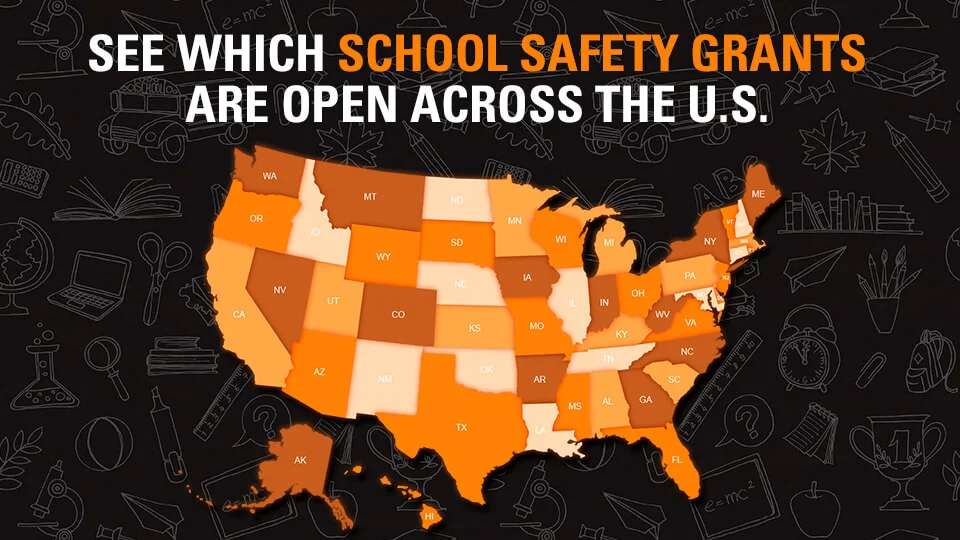

School Safety Grants

See Which School Safety Grants Are Open Across the U.S.

While safety is a top concern for schools, we understand that not all schools have the resources they need in order to implement crucial security and school safety technology. Government grants are available to help bridge that gap.

Motorola Solutions has partnered up with the grant experts at EducationGrantsHelp.com to help with grant research, grant alert notices and grant application reviews in order to ensure you have a successful application.

Please click on this link to find open grants in your area.

Motorola Solutions has partnered with the experts at PoliceGrantsHelp, GovGrantsHelp, FireGrantsHelp and the Partner Alliance for Safer Schools (PASS) to provide you with free grant assistance programs. Get started on your application today!

Safety and Security Guidelines

Partner Alliance for Safer Schools (PASS)

First established in 2014, the Partner Alliance for Safer Schools (PASS) brings together expertise from the education, public safety, and industry communities to develop and support a coordinated approach to making effective use of proven security practices specific to K-12 environments, and informed decisions on security investments.

Mission

The mission of PASS is to provide school administrators, school boards and public safety and security professionals with information, tools and insight needed to implement a tiered approach to securing and enhancing the safety of school environments based on their individual needs, nationwide best practices, and making the most effective use of resources available.

Vision

PASS supports efforts by communities throughout the United States to provide and sustain an effective level of security appropriate to each district and K-12 facility, recognizing that making schools safer is both achievable and urgently needed.

Safety and Security Guidelines for K-12 Schools

The PASS Guidelines identify and classify best practices for securing K-12 facilities in response to urgent needs for information identified by the education community. The guidelines include:

- Specific actions that can effectively raise the baseline of security.

- Vetted security practices specific to K-12 environments.

- Objective, reliable information on available safety and security technology.

- Assessment of current security measures against nationwide best practices.

- Multiple options for addressing security needs identified, based on available resources.

- How to distinguish needed and effective solutions from sales pitches on unnecessary products.

Download the PASS Safety and Security Guidelines 6th Edition

Government Grants

- Airport & Port Security

- Education

- Fire & EMS

- Healthcare

- Law Enforcement

- Transportation

- Government Grants Home

Have a question?

Request a Quote